Your bridge betweensustainability and finance

Supported over $175 million of funding into green buildings projects

What is UnetyA virtual broker to secure funding

Unety is a platform that combines underwriting and automation software with a private marketplace to enable property owners and sustainability professionals to easily secure the best funding for eco-friendly upgrades to commercial buildings of any size.

Bank-ability score

Compare funding options

Customized costs, benefits, & ROI

Connect to financial providers

Fund your projectTrusted by leaders at the intersection of sustainability and finance

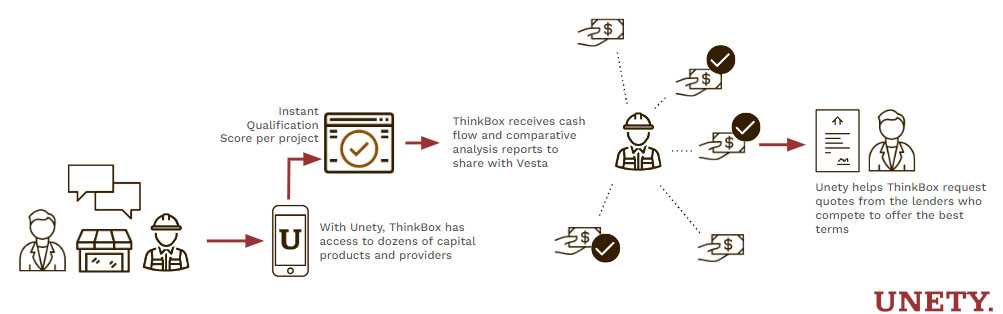

Case Study – ThinkBox & VestaVesta Corp. needed $30mm of funding for a portfolio of 14 projects in 14 cities being developed by ThinkBox. ThinkBox used Unety to help Vesta source, compare, understand, and decide on funding options – all delivered in 48 hours.

Tools for any clean energy professionalHere are some of the supported project types

Water

Equipment that transports or stores water. Examples range from basic pipes, pumps, and controls to modern rainwater catchment or water recycling systems, and all that's in between.

HVAC

Systems or equipment used to regulate and control the temperature inside a building, including hot water. Some examples are vents, risers, ducts, air-handlers, chillers, and more.

Lighting

Equipment installed inside a building or fixed to the exterior of a building and used for lighting, including switches, wiring, ballasts, sensors, dimmers, controls, mounts, lamps, and bulbs.

Landscaping

Sustainable landscaping brings a building to life. Examples include greenroofs, xerioscaping, drought tolerant landscaping, high efficiency irrigation equipment, and much more.

Renewables

The equipment must be installed at the same location where the power will be used. Battery storage, wind power, geothermal, tidal, piezoelectricity, solar thermal, and solar PV are supported.

Envelope

Any number of projects that improve or add to the insulation of a building. This includes roof repairs or replacements, new windows or doors, and even some exterior walls.

New construction

Up to 60% of the cost of a construction of new building can be funded by sustainable finance. Property acquisition does not qualify.

Resiliency

Projects that protect a building from the forces of nature, including flooding, huricanes, and earthquakes qualify in select jurisdictions.

Equipment

Commercial and industrial equipment may qualify, depending on how it is installed. This includes ovens, refridgeration, process water, and water treatment.

Savings calculator

See how much you can gain when you finance through Unety

Your results

More information is needed

Contact a contractor to learn more

Get DemoFinancing insights for sustainabilitySelect the tool for you

Tools for professionals

Our tools match properties and projects to types of financing, based on property owner qualifications, project conditions, and user preferences. Our tools automate business processes and improve productivity for salespeople, contractors, and lenders.

Learn more